Credit Invoice

A credit note is a legal document used to cancel a previously issued invoice partially or in full A customer refund is the most common example of the credit invoice definition, but there are numerous circumstances where this notation can apply.

What is a credit invoice used for?

- Customer returns - the customer asks for a refund

- Partial credit for a part-refund

- Invoice error - an error with the amount on the original invoice

- The invoice was issued by mistake

Configuring credit invoicing

An employee must be assigned to the shop with a Shop Admin or Shop Owner Admin role to perform actions referred to in this section.

Credit Invoice document template is set on a shop level. Please check Creating and Editing Document Templates and Managing Document Templates You can also define the credit reasons as a part of Return configuration.

As a Shop owner you can define whether to state shipping costs when issuing a full credit invoice or not. Shipping costs are stated on the credit invoice only when the complete order is credited. If the setting is off, the shipping costs are not stated on the credit invoice.

IF shipping costs were invoiced AND full order was returned OR last item of order was returned AND shipping option is standard

You can change the setting per shop or shop owner from the corresponding detail pages: Shop settings > Financial > Invoice > Credit Invoice section - State shipping costs on crediting

Shop owner settings > Financial > Invoice Management > State shipping costs on crediting

Store settings take precedence over store owner settings.

How to create a credit invoice

You can create partial or full credit invoices from the invoices table, or from the corresponding order details page. Credit invoice could be issued automatically as part of the Manage Returns process. In this case the return reason will be used as a credit reason as well.

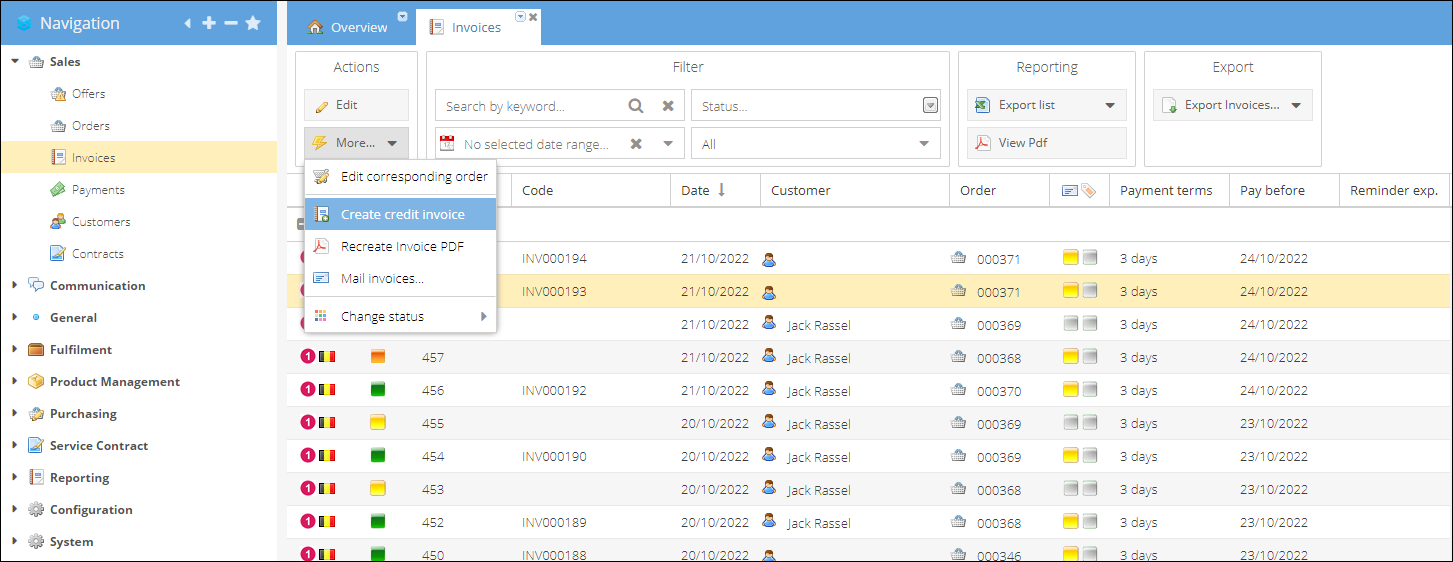

Create credit invoice from invoices table

To create a credit invoice and refund from the invoice table:

- Log in as a Power user (an employee, with granted permission to create invoices).

- Open the Sales > Invoices tab.

- Locate and select an invoice that needs to be credited.

- In the top actions menu click More > Create credit invoice.

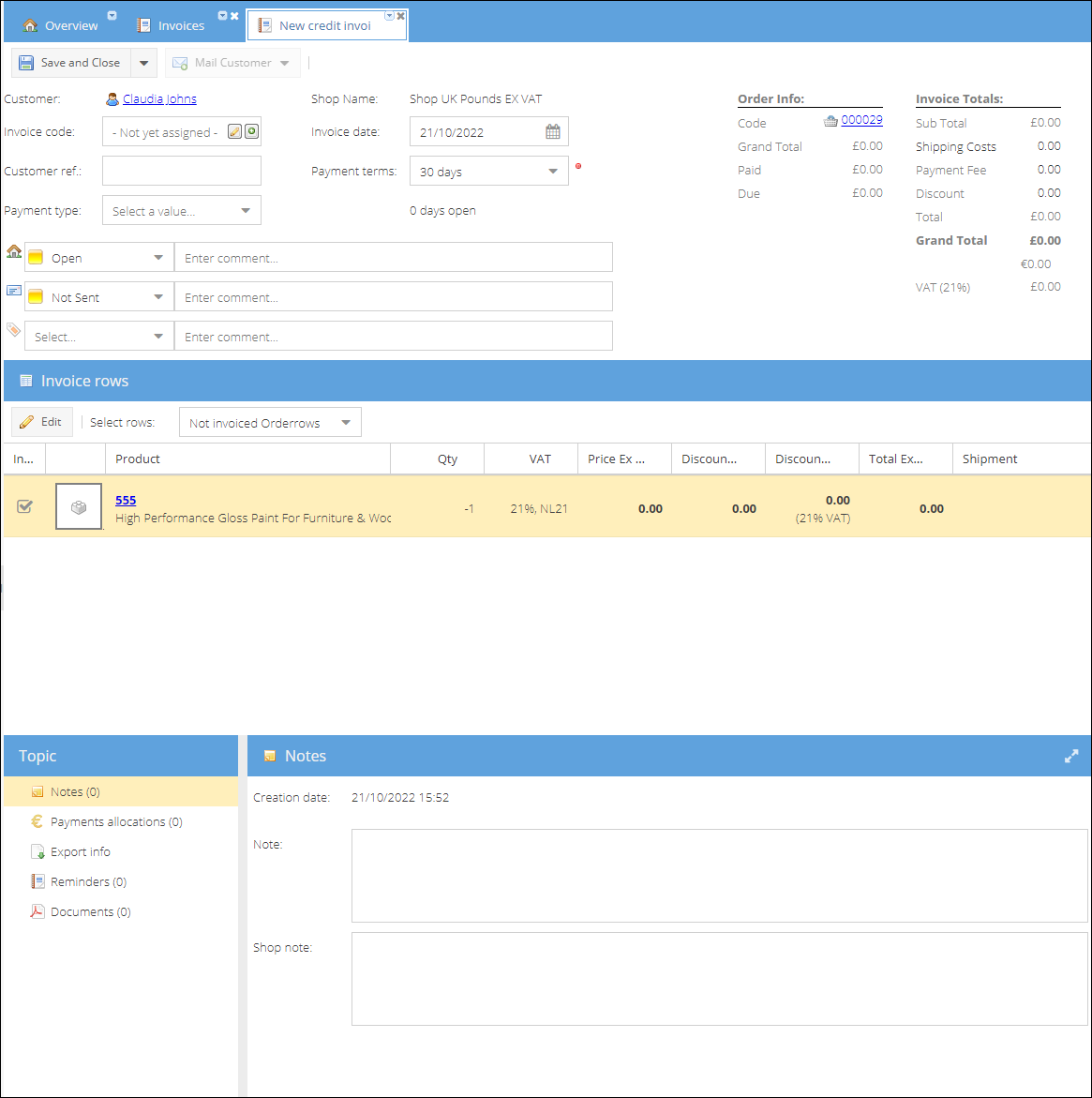

- A new credit invoice details page will be opened in a new tab.

- You can proceed with assigning and editing Invoice code.

- Once done, click Save and Close. The invoice document will be autogenerated and attached to both the credit invoice and original order.

- You can also Save, close and mail the credit invoice to a customer by selecting this option in a dropdown on a Save and close button.

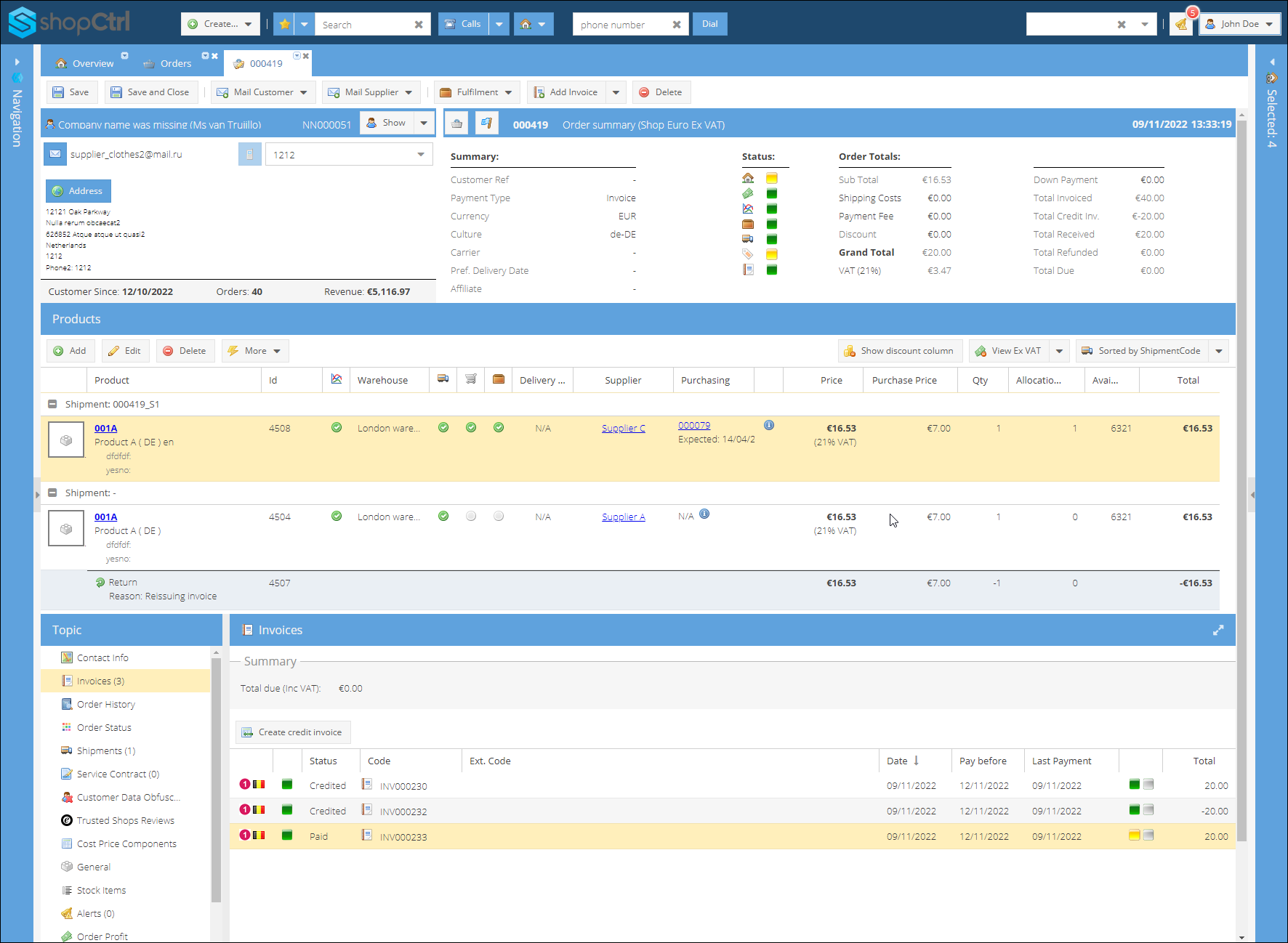

Create credit invoice from order details

To create a credit invoice from the order details page:

- Locate and open the order that needs to be credited on the Sales > Orders table.

- Go to the Order details page > Invoices tab.

- Select Invoice row.

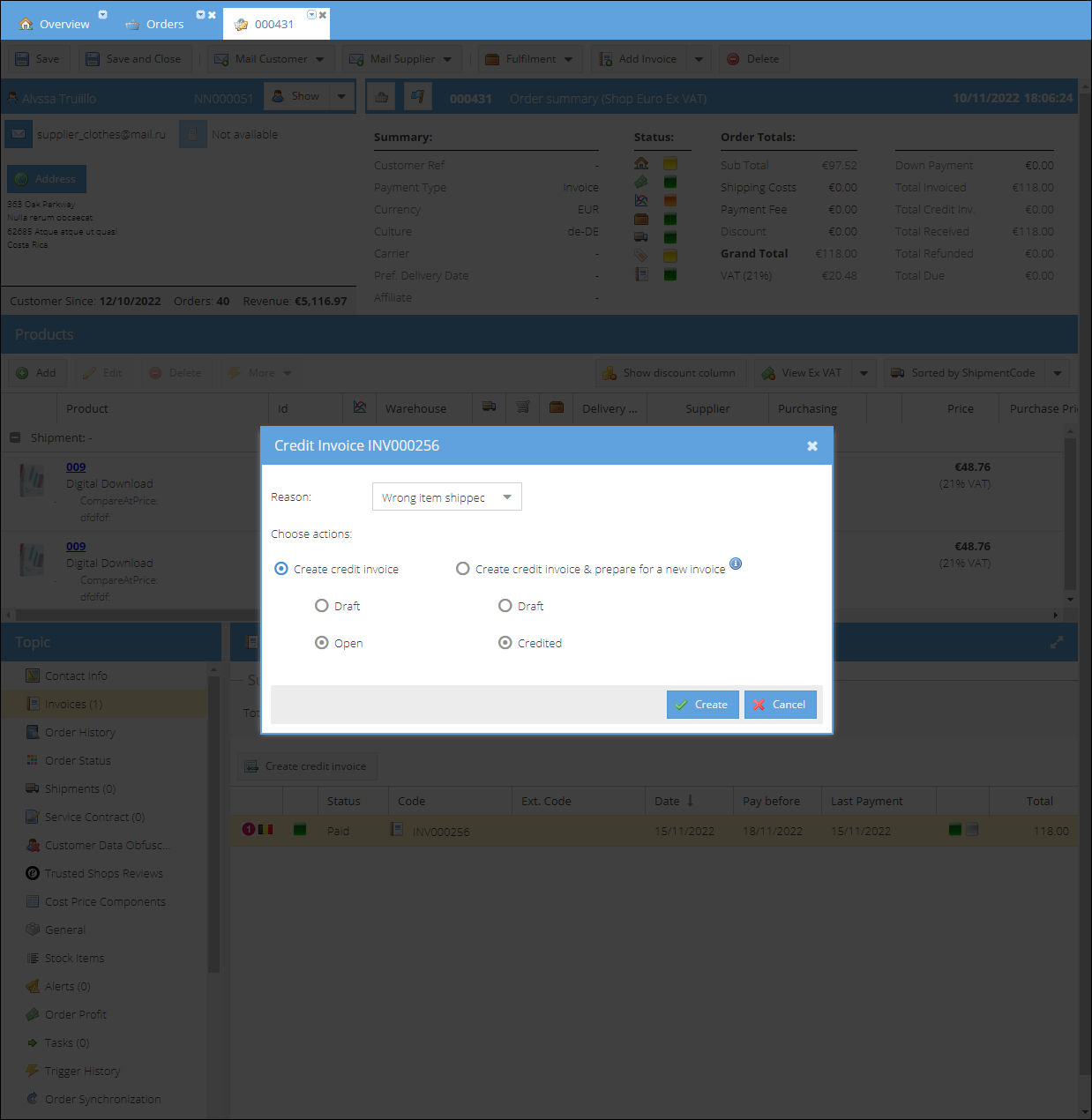

- Click Create credit invoice and a popup window will be opened.

- Select Reason to credit the previous invoice.

- Choose Create credit invoice and the status in which the invoice will be created:

- Draft - Credit invoice will be created in a Draft status without an invoice code assigned

- Open - Credit invoice will be created in an Open status, invoice code will be assigned automatically

- Click Create to issue a new credit invoice.

After the new invoice is created, you can proceed with assigning an invoice code (for draft status invoices) and communicating it with the customer.

How to re-issue erroneous invoice:

This part describes a process of handling the scenario when a credit invoice is created as a part of re-issuing an erroneous invoice. The invoice could be already paid, or not paid.

Here are the main steps of the process of re-issuing an invoice if any correction is needed:

- Create credit invoice for the erroneous initial invoice.

- Copy the order rows to be later included in a correct invoice

- De-assign old invoice payment allocations to be later assigned to a correct invoice

- If order was already shipped, to keep stock records correct old stock items also should get deassigned from order rows and linked to the newly created duplicate ones.

- Last step - issue a new correct invoice for the same order and allocate a payment received from a customer.

To create credit invoice and prepare for the new invoice:

- Open the order that needs correction.

- Go to the Order details page > Invoices tab.

- Select erroneous Invoice.

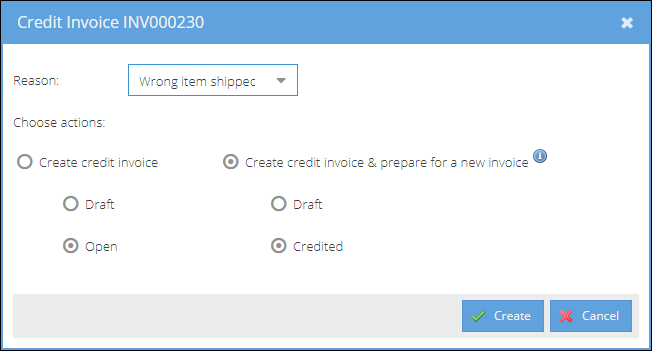

- Click Create credit invoice and a popup window will be opened.

- Select Reason to credit the previous invoice.

- Choose Create credit invoice & prepare for a new invoice and the status in which the invoice will be created:

- Draft - Credit invoice will be created in a Draft status without an invoice code assigned

- Credited - Credit invoice will be created in a Credited status, invoice code will be assigned automatically

- Click Create.

The order rows are credited with a reason specified, and duplicated with all the corresponding shipping information. If the invoice was paid already, the payment is de-allocated from the initial erroneous invoice. Initial and new credit invoices credit each other out, the corresponding dummy payments are created as part of this process.

At this point the customer contact info, or any data that needs correction can be changed. So that a new invoice will have the correct information. You can now proceed to manually create the correct invoice. The payment will be allocated automatically once the invoice is saved.